2022 tax refund calculator canada

This marginal tax rate means that your immediate additional income will be taxed at this rate. The Canada Annual Tax Calculator is updated for the 202223 tax year.

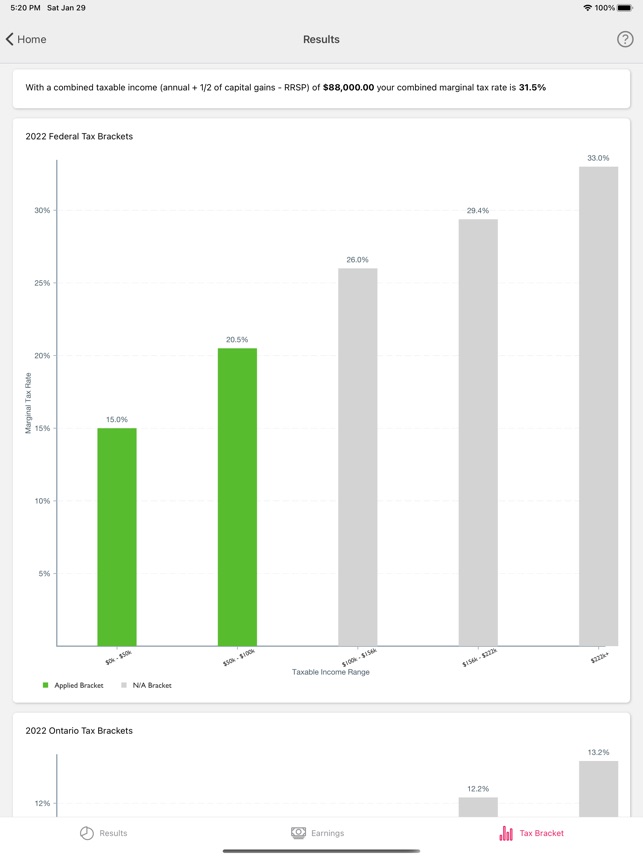

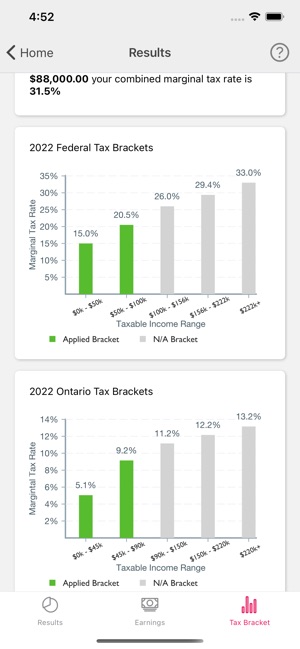

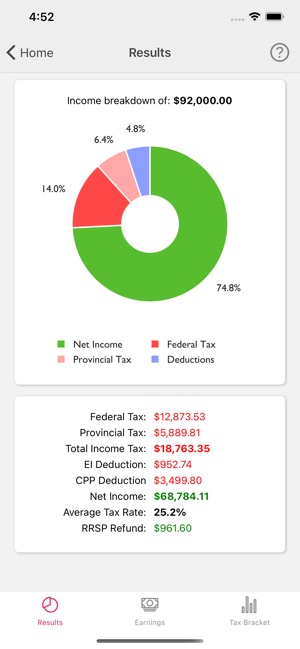

Canada Income Tax Calculator On The App Store

Below there is simple income tax calculator for every Canadian province and territory.

. Use our simple 2021 income tax calculator for an idea of what your return will look like this year. 2022 tax refund calculator canada. This Tax Return and Refund Estimator is currently based on 2021 tax tables.

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. This link opens in a new window. This calculator is for 2022 Tax Returns due in 2023.

The 31st day after you file your return. Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax. 2022 Tax Return and Refund Estimator for 2023.

The best starting point is to use the Canadian tax refund calculator below. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables.

It is not your tax refund. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Annual Tax Calculator 2022.

If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. Youll get a rough estimate of how much youll get back or what youll owe. IT is Income Taxes.

Federal tax rates for 2022 15 on the first 50197 of taxable income plus. Start with a free eFile account and file federal and state taxes online by April 18 2022. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

For example if your non-refundable credits total 20000 and your taxable income is 40000 you are in the first tax bracket. 2022 Personal tax calculator. Calculate the tax savings your RRSP contribution generates in each province and territory.

British Columbia tax calculator. Shows combined federal and provincial or territorial income tax and rates current to. Or you can choose tax calculator for particular province or territory depending on your residence.

Here is a list of credits based on the province you live in. Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000 Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results W-4 PRO Bonus included in salary. Most people want to find out if its worth applying for a tax refund before they proceed.

2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax commitments. Meet with a Tax Expert to discuss and file your return in person. Meet with a Tax Expert to discuss and file your return in person.

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. File your taxes the way you want. Interest on your refund.

This means that you are taxed at 205 from your income above 49020 80000 - 49020. This way you can report the correct amounts received and avoid potential delays to. The calculation will start on the latest of the following three dates.

This handy tool allows you to instantly find out how much Canadian tax back you are owed. 2022 RRSP savings calculator. That means that your net pay will be 40568 per year or 3381 per month.

Your average tax rate is 220 and your marginal tax rate is 353. The best starting point is to use the Canadian tax refund calculator below. The calculator reflects known rates as of January 15 2022.

Reflects known rates as. The CRA will pay you compound daily interest on your tax refund for 2021. The Canadian tax calculator is free to use and there is absolutely no obligation.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Calculate your combined federal and provincial tax bill in each province and territory. Have a refund of 2 or less.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. For more information see Prescribed interest rates. The day after you overpaid your taxes.

In Canada each province and territory has its own provincial income tax rates besides federal tax rates. Heres what you need to know. Stop by an office to drop off your documents with a Tax Expert.

It is intended only as a general guide and is neither a definitive analysis of the law nor a substitute for professional advice. Conquer your income taxes with our free and easy-to-use income tax calculator. You simply put in your details get.

TurboTax Free customers are entitled to a payment of 999. 8 rows Canada income tax calculator. This personal tax calculator does not constitute legal accounting or other professional advice.

40000 x 15 20000 x 15 6000 3000 3000 in net federal tax. The rates apply to the actual amount of taxable dividends received from taxable canadian corporations.

2019 Canadian Tax Tips My Road To Wealth And Freedom Canadian Money Tax Refund Finances Money

Hello Summer Real Estate Marketing Postcard Real Estate Summer Home Maintenance Tips Card Real Estate Farming Template Editable On Canva In 2022 Real Estate Marketing Postcards Email Marketing Platform Etsy

Canada Income Tax Calculator On The App Store

How Does A Tax Refund Work In Canada Nerdwallet Canada

How To Register And Open A Cra My Account In 2022 Personal Finance Lessons Energy Saving Tips Accounting

Mortgage Calculators Mortgage Calculator Online Mortgage Mortgage

Simple Tax Calculator For 2021 Cloudtax

Canada Income Tax Calculator On The App Store

Phelps Woman Arrested For Dwi In 2022 State Police Police Arrest

Schedule C Form 1040 Irs Taxes Accounting And Finance Schedule

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Canada Income Tax Calculator On The App Store

Schedule C Form 1040 Irs Taxes Accounting And Finance Schedule

Tax Return Bella Vista Accountant Bookkeeping Accounting Services Flexible Jobs Estate Planning Design Jobs

Online Payment Invoice Tax Bills Accounting Services Vector Isometric Concept Accounting Payment Isometric Pay Accounting Online Payment Accounting Services

The Ultimate 5 Property Rental Real Estate Template Excel Etsy In 2022 Real Estate Investing Rental Property Rental Property Management Rental Property Investment

In The United States The Internal Revenue Service Requires That Individual Taxpayers Who Have Not Had Sufficie Inheritance Tax Tax Deductions Tax Free Savings

Simple Tax Calculator For 2021 Cloudtax

10 Reasons You Should Really Fear An Irs Audit Tax Mistakes Best Health Insurance Business Tax